,

Section 179 Deduction Vehicle List 2024

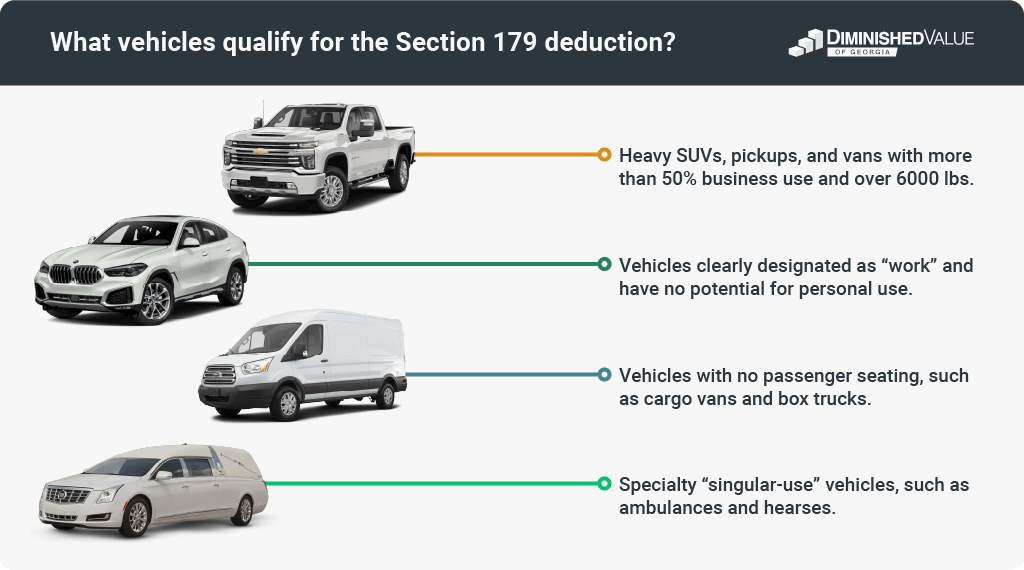

Section 179 Deduction Vehicle List 2024 – Section 179 has been referred to as the “SUV tax loophole” or “Hummer deduction” because it was often used to write off the purchase of qualifying vehicles. The positive impact of Section . The deduction on such vehicles was capped following controversy over some business owners essentially buying luxury vehicles for personal use and writing off the full cost under section 179. .

Section 179 Deduction Vehicle List 2024

Source : www.xoatax.comSection 179 Eligible Vehicles at Bob Moore Auto Group

Source : www.bobmoore.comSection 179 Deduction – Section179.Org

Source : www.section179.orgList of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in

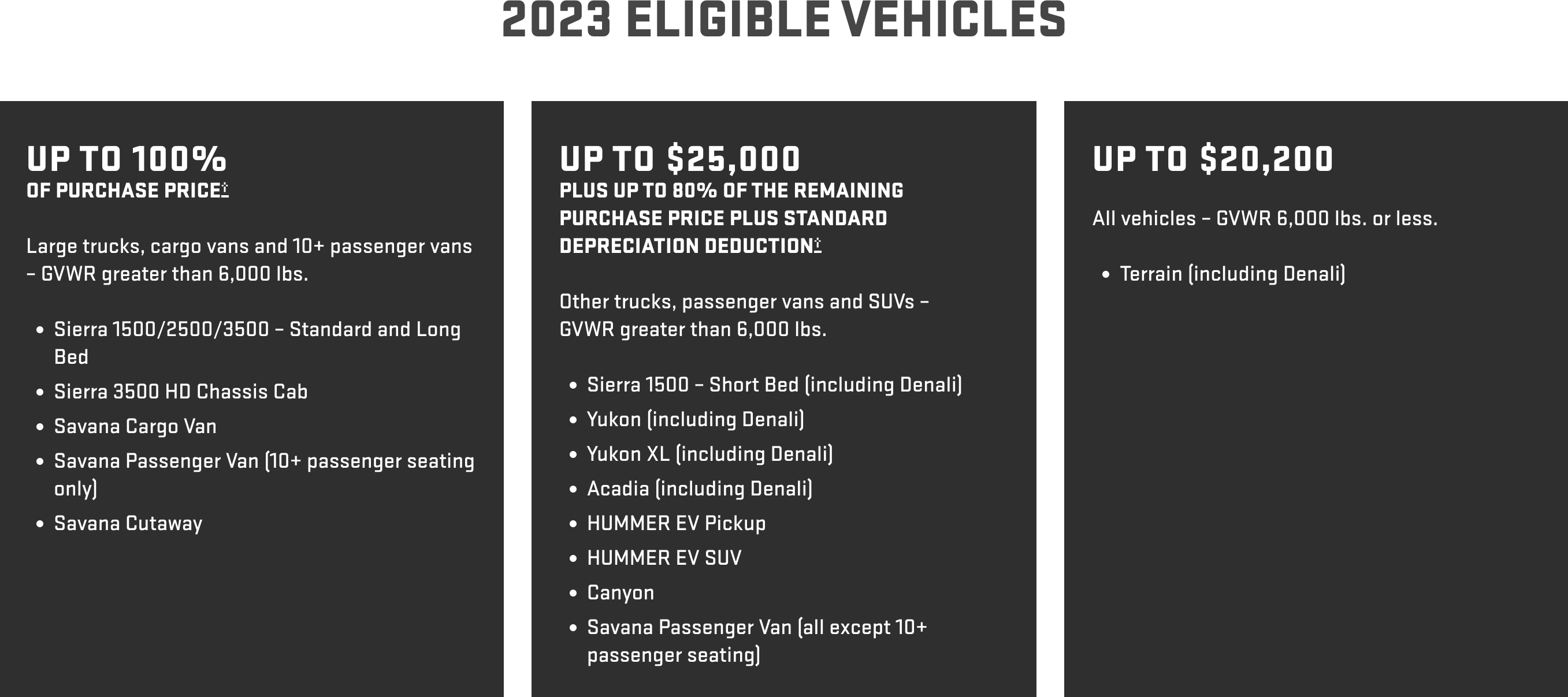

Source : diminishedvalueofgeorgia.comUnderstanding The Section 179 Deduction Coffman GMC

Source : www.coffmangmc.comSection 179 & Bonus Depreciation Saving w/ Business Tax Deductions

Source : www.commercialcreditgroup.comUpdate] Section 179 Deduction Vehicle List 2024 | XOA TAX

Source : www.xoatax.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comMaserati Section 179 Deduction for Vehicles | Joe Rizza Maserati

Source : www.joerizzamaserati.comSection 179 Vehicles For 2024 Balboa Capital

Source : www.balboacapital.comSection 179 Deduction Vehicle List 2024 Update] Section 179 Deduction Vehicle List 2024 | XOA TAX: Qualifying equipment includes business machines, office equipment, computer software and furniture, as well as vehicles that qualify for the write-off. For 2012, the maximum Section 179 deduction . A fraction of the time a piece of equipment, vehicle, or software is used for business purposes is enough to qualify for a deduction under Section 179. To calculate the monetary amount that qualifies .

]]>